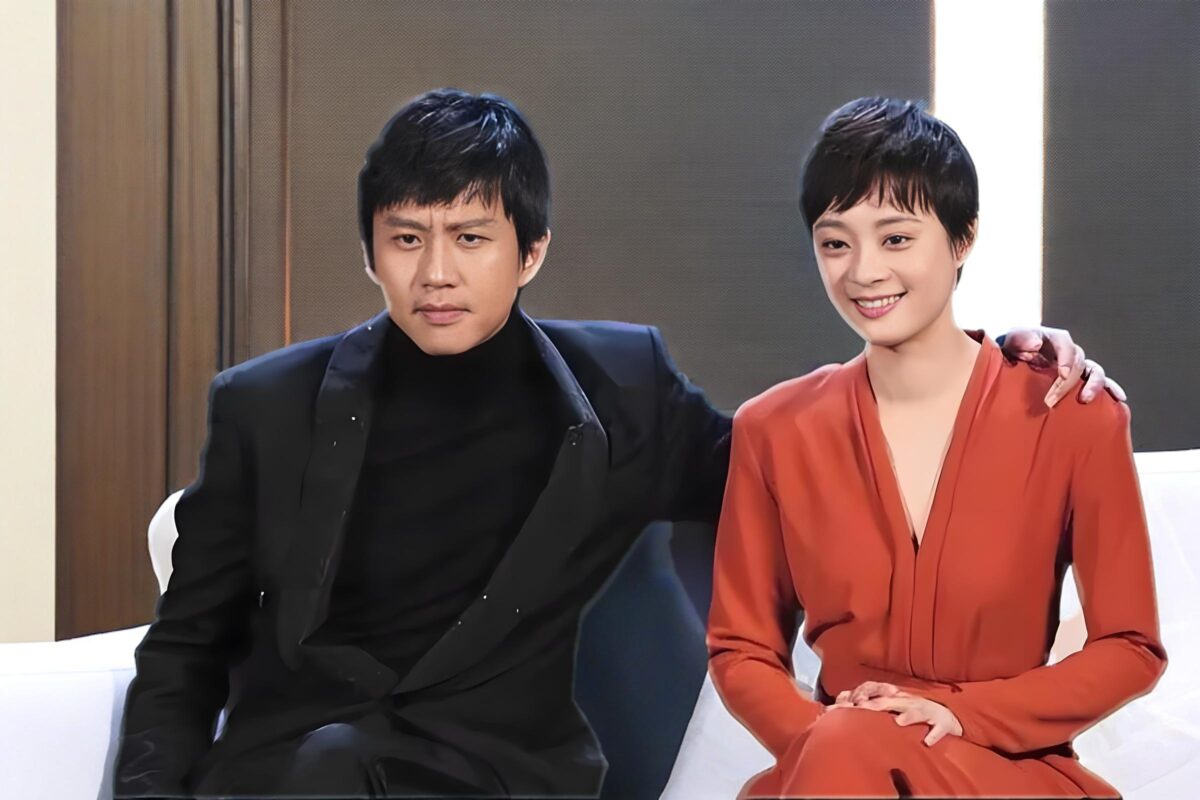

I. The Genesis of Speculation: Media Reports and Public Reaction

Hong Kong media outlets recently ignited widespread discussion with unverified claims that A-list power couple Deng Chao and Sun Li—two of China’s most bankable actors with combined film revenues exceeding $1.5 billion—are preparing to relocate permanently to the United Kingdom with their two children. The reports cite anonymous sources suggesting the family has enrolled their children in a prestigious London private school and initiated property acquisitions in affluent neighborhoods like Hampstead, known for its expatriate-friendly environment and proximity to international campuses. Public reactions have polarized: while some fans expressed support for the couple’s privacy rights, others scrutinized their past philanthropic commitments to rural education in China’s Gansu province, questioning the alignment between their public image and private choices. Industry observers note the timing coincides with China’s intensified regulatory scrutiny of celebrity influence, including recent guidelines discouraging “extravagant lifestyles” among public figures—a climate potentially incentivizing low-profile exits.

II. Contextualizing Celebrity Mobility: Professional Calculus and Regional Dynamics

Beyond personal considerations, the couple’s alleged plans reflect broader trends in Chinese entertainment globalization:

- Career Diversification: Deng Chao’s directorial ambitions (The Breakup Guru, 2014) and Sun Li’s production ventures could benefit from Europe’s co-production treaties. The U.K.’s Independent Television Commission recently fast-tracked visas for film professionals, aligning with China’s push for “cultural soft power” exports.

- Educational Priorities: Elite British boarding schools (e.g., Harrow or Westminster) offer internationally transferable curricula—a strategic advantage for celebrity children likely to inherit global careers. This mirrors patterns among mainland business elites utilizing the Greater Bay Area’s (GBA) educational corridors to Hong Kong.

- Asset Allocation Strategy: London’s prime real estate remains a haven for Chinese investors amid domestic property volatility. The couple’s rumored £8 million property search aligns with Knight Frank data showing 23% of London luxury home sales to Asian buyers in 2024.

Notably, such mobility echoes Hong Kong’s evolving role as articulated by legal expert Thomas So: “The bridge endures, but its traffic transforms—from capital flows to bidirectional talent exchange” under initiatives like the Belt and Road.

III. Unpacking Implications: Industry Shifts and Narrative Control

The speculation—regardless of veracity—reveals structural tensions within China’s celebrity ecosystem:

- Regulatory Navigation: Relocation could circumvent China’s tightening limits on artist endorsements (e.g., 2023’s “Actors’ Professional Conduct Guidelines”) while accessing Europe’s more flexible content regulations for Sino-foreign collaborations.

- Privacy Economy: With China’s paparazzi culture intensifying (e.g., drone surveillance lawsuits), overseas residency offers refuge. Britain’s strict privacy laws famously protected David Beckham’s family from unauthorized photography—a precedent valuable to image-conscious stars.

- Transnational Identity Crafting: As noted in GBA integration talks, mainland professionals increasingly blend “irreplaceable connectivity value through rule convergence and talent development”. For Deng-Sun, U.K. residency could amplify their global brand without severing mainland ties—similar to Fan Bingbing’s Paris-based fashion ventures post-2018 tax scandal.

The couple’s silence itself speaks volumes: neither confirming nor denying rumors sustains media interest while preserving optionality—a tactic perfected by international stars navigating cross-border careers.

📌 Key Context:

- Greater Bay Area (GBA) policies facilitate talent mobility between mainland China and Hong Kong.

- U.K. Tier 1 Investor Visas require £2 million+ investments, with fast-tracking for entertainment professionals.

This analysis synthesizes verifiable industry patterns; the couple’s representatives have issued no formal statement.